Several bank failures, and the high volatility in US bank equity prices, have raised considerable concern in recent weeks. The March 10 failure of Silicon Valley Bank (SVB) followed just two days later by that of Signature Bank shocked many observers. There were hopes that these were isolated incidents, but other regional banks soon came under pressure. First Republic Bank suffered a collapse in its share price and was taken over by regulators and then sold to JP Morgan on May 2. (Figure 1 tracks the fall in US equity prices and an index of US bank stocks).

Figure 1. United States Stock Prices: General Index (MSCI) and Banking Index

The pressure on regional bank equity valuations continued. On May 4, their stock prices, including those of Pacific Western Bank (PacWest) and Western Alliance Bank, plummeted. Short sellers acting on rumor and partial information rather than a true appreciation of bank fundamentals were blamed for fueling this volatility in equity prices. Although significantly smaller than SVB and First Republic, PacWest has drawn attention among market observers because of some similarities to SVB, including ties to the tech community, uninsured deposits, and paper losses on its securities portfolio.

Latin America and the Caribbean has suffered many banking crises. The current situation bears some resemblance to the Tequila Crisis in Argentina in 1995, which began in late 1994 after the devaluation of the Mexican peso and the failure of a very small bank in Argentina at the very end of that year. Argentina had no deposit insurance at the time, and doubts about the solvency of other smaller banks caused depositors to withdrew funds from those entities based as much on rumor as on fact. In the first stage of the crisis, larger banks gained deposits. But political uncertainty grew as a presidential election loomed. This combined with the weaknesses in the banking system provoked a systemic run that was only halted after an IMF agreement that boosted confidence and the completion of the election, which reduced uncertainty.

In such situations, certain characteristics of individual banks may highlight perceived vulnerabilities. For example, Silicon Valley Bank had a large share of concentrated uninsured deposits and suffered significant losses from certain fixed rate products as interest rates rose. Some regional banks also have a reportedly high exposure to commercial real estate, a sector which has suffered since the pandemic. Macro factors are also often at play. Given the current inverted yield curve, banks that had cheap short-term deposits and are locked into longer-term assets, may be facing reduced or even negative term spreads. And rumors may prompt worried (particularly uninsured) investors to withdraw funds, potentially creating a self-fulfilling prophecy.

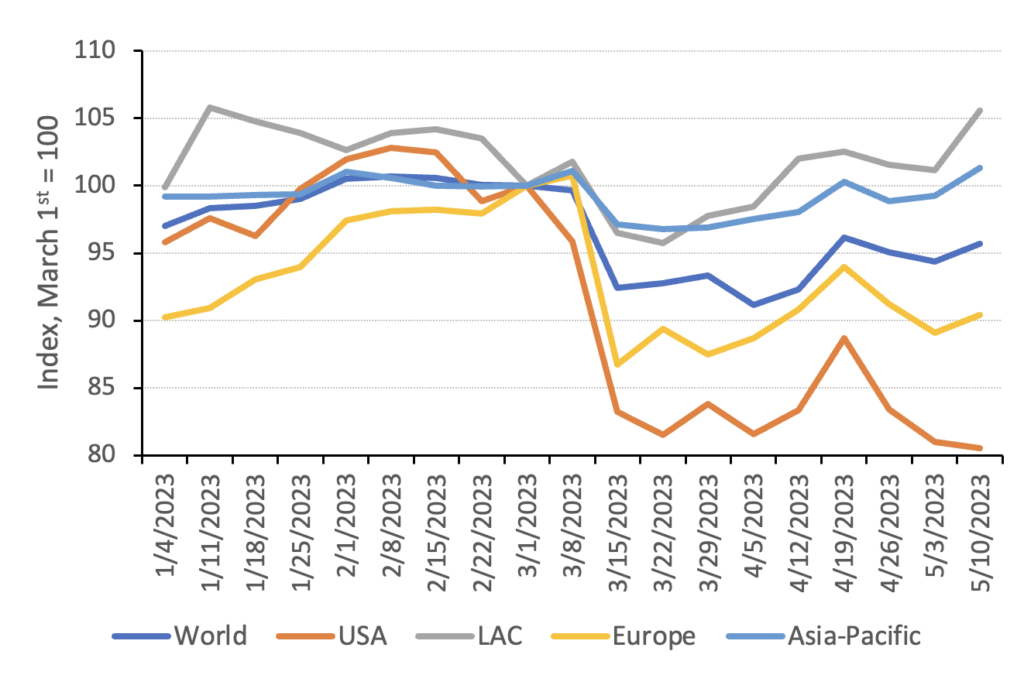

How have these banking issues in the United States impacted banks in other regions? Figure 2 shows the steep decline in bank stock prices in the US compared to those of other regions. After the US, Europe was the most affected region. This was in large part due to other problems arising in European banks, most notably Credit Suisse, which was then absorbed by another large Suisse entity, UBS. As illustrated in Figure 2, Latin America and the Caribbean and Asia-Pacific were the least impacted regions. While US bank stocks fell by 15% after the collapse in SNB, an index of banks in Latin America and the Caribbean fell by only 5%, similar to the decline in the Asia-Pacific region.

Figure 2. Bank Equity Prices: The US Compared to Other Regions

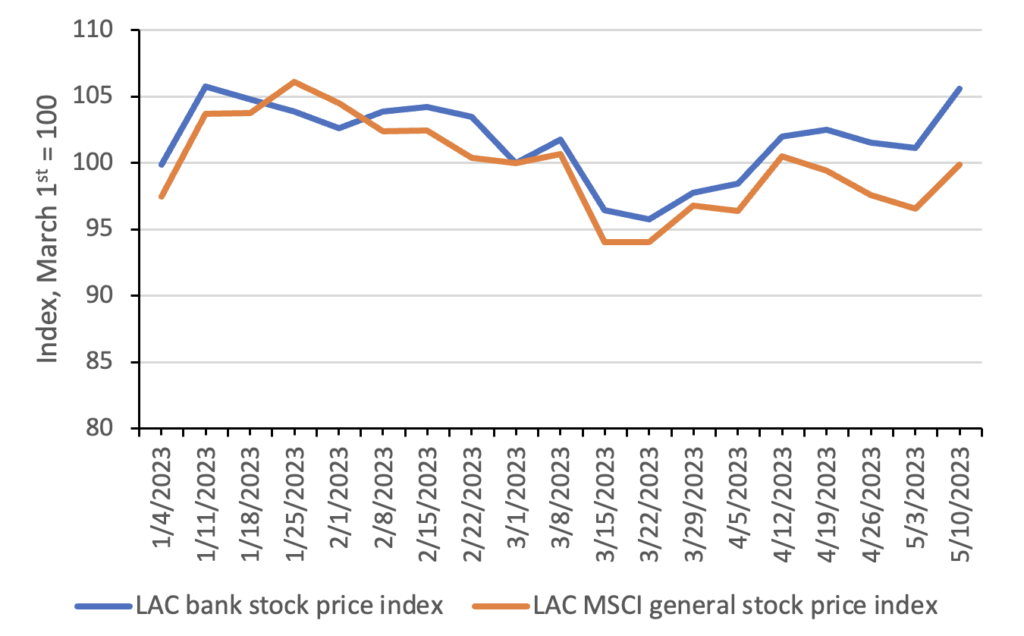

It is worth noting that in Latin America and the Caribbean the bank stock index essentially followed the more general stock market index (see Figure 3), such that the 5% fall reflected the decline in stocks generally. This was not the case in the US (as shown in Figure 1).

Figure 3: Latin America and the Caribbean Stock Prices: General Index (MSCI) and Banking Index

Still, even in the United States the effect on banks varied dramatically. While regional banks have come under significant pressure, the impact on the larger banks has been much milder. Indeed, just as in Stage 1 of Argentina’s Tequila Crisis, the larger banks in the US have reported deposit inflows even as the smaller regional banks have reported outflows. There has also been a general outflow of deposits in favor of short-term money market instruments and bonds as interest rates have risen. But banks are now responding with high interest deposit accounts.

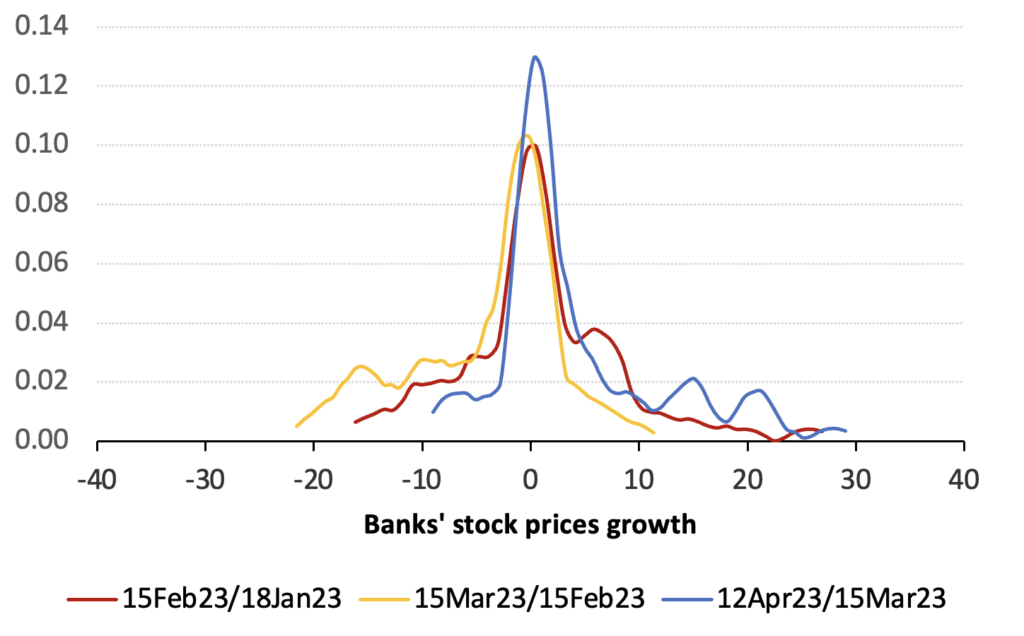

To illustrate the heterogeneity in stock price fluctuations across banks, Figure 4 plots the distribution of the changes in equity prices in the US (Panel A) and Latin America and the Caribbean (Panel B). The US distribution shifted sharply to the left, and a large left tail developed after the collapse in SVB, largely driven by the regional banks. This pattern is not evident in Latin America and the Caribbean.

The median bank in the US suffered a fall in its equity value of 9.4% between mid-February and mid-March (just after the SVB collapse). But that same figure is just -1.6% in the case of banks in Latin America and the Caribbean. And considering the left tail of the distribution, the 25th percentile bank in the US experienced a 16% fall between mid-February and mid-March and a further fall of 8.2% between mid-March and mid-April. The analogous bank in Latin America and the Caribbean fell 8.7% in February-March and did not drop at all in March-April (equity values remained unchanged).

Figure 4. Distribution of Equity Price Changes in the US and in Latin America and the Caribbean

Panel A. United States

Panel B. Latin America and the Caribbean

There are many links between the financial system in the US and those in Latin America and the Caribbean. It is then perhaps somewhat surprising that there has not been more contagion of current US fragilities to the region. Still, the problems have occurred almost exclusively in the smaller regional banks that in general do not have significant financial relations with banks in other countries. The larger national and international US banks, that do have close ties with Latin America and the Caribbean and other regions, have been relatively unscathed.

Still, the smaller regional banks in the US are important for the US economy. They account for a disproportionate share of loans (i.e.: loans are a greater proportion of their assets compared to the larger banks). They are particularly significant in supplying credit to small- and medium-sized enterprises that may not have easy access to other funding sources. Depending on how long the current regional banking crisis lasts and how it is resolved, there could be contagion through lower US growth.