Continue Working Closely with Macau Community to Control COVID-19

Q3 2022 Group Adjusted EBITDA of $(0.6) Billion Vs $0.5 Billion in Q3 2021

Continue Effectively Controlling Costs & Remains Financially Healthy

Continue Investing in Macau’s Future with Cotai Phases 3 & 4

HONG KONG–(BUSINESS WIRE)–Galaxy Entertainment Group (“GEG”, “Company” or the “Group”) (HKEx stock code: 27) today reported results for the three-month period ended 30 September 2022. (All amounts are expressed in Hong Kong dollars unless otherwise stated)

LETTER FROM THE CHAIRMAN OF GALAXY ENTERTAINMENT GROUP

I appreciate the opportunity to update you on GEG’s most recent activities and financial results for the third quarter of 2022. We continue to remain very supportive of the Macau Government and actively promote public health and safety as well as economic and social stability. Further, we were encouraged by the 20th National Plenary Session where the “One Country, Two Systems” principle has been highlighted and will fully support the two SARs.

We have submitted our Macau gaming concession tender which has been formally accepted as a valid tender by the Macau Government. We are well positioned to support the long term development of Macau and its vision of becoming a World Centre for Tourism and Leisure.

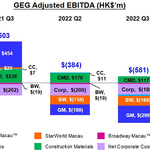

Moving onto our Q3 2022 performance, the elevated COVID-19 related travel restrictions imposed in Q2 flowed into Q3 and even resulted in the closure of casinos for 12 days during the quarter. This impacted visitation, revenue and profitability. In Q3 2022, Group Net Revenue was $2.0 billion, down 52% year-on-year and down 16% quarter-on-quarter. Group Adjusted EBITDA was $(581) million, Vs $503 million in Q3 2021 and $(384) million in Q2 2022.

Our balance sheet remains liquid and healthy. As of 30 September 2022, cash and liquid investments were $22.5 billion and net cash was $19.3 billion. Core debt remains relatively unchanged at $0.3 billion. This provides us with valuable flexibility in managing operations and supporting our ongoing development initiatives.

Moving onto our development update, we continue to make ongoing progressive enhancements to our resorts to ensure that they remain competitive and appealing to our guests. We also continue to invest in Macau with our Cotai Phase 3 effectively completed and continue to move forward with Phase 4, our next generation integrated resort, which will complete our ecosystem in Cotai. As you can see, we remain confident about the future of Macau where Cotai Phases 3 & 4 will support Macau’s vision of becoming a World Centre of Tourism and Leisure.

We are encouraged by Macau reopening its borders to 41 foreign countries on 1 September 2022 where visitors are required to undergo seven days of hotel quarantine upon entry. Furthermore, the resumption of E-visas was effective on 1 November 2022, and package tours to Macau are expected to resume shortly. It is anticipated that this will drive an increase in visitation and revenue for the market.

Going forward in the medium to longer term, we remain confident in the future of Macau. However, we do acknowledge that further potential outbreaks of COVID-19 may impact our future financial performance. Finally, I would again like to thank the Macau Government and the health and emergency personnel who have worked so hard to ensure the safety of Macau. I would also like to thank our staff for participating in our various voluntary community programs. Thank you.

Dr. Lui Che Woo

GBM, MBE, JP, LLD, DSSc, DBA

Chairman

|

Q3 2022 RESULTS HIGHLIGHTS GEG: Continues to be Impacted by COVID-19 and Travel Restrictions

Galaxy Macau™: Continues to be Impacted by COVID-19 and Travel Restrictions

StarWorld Macau: Continues to be Impacted by COVID-19 and Travel Restrictions

Broadway Macau™: Continues to be Impacted by COVID-19 and Travel Restrictions

Balance Sheet: Maintain a Healthy and Liquid Balance Sheet

Development Update: Continue Making Progress on Cotai Phases 3 & 4

|

Market Overview

The performance of the tourism and gaming industry was adversely impacted by the elevated travel restrictions that were carried into Q3 2022. Based on DICJ reporting, Macau’s Gross Gaming Revenue (“GGR”) for Q3 2022 was $5.4 billion, down 70% year-on-year and down 35% quarter-on-quarter.

The increased travel restrictions and quarantine rules impacted visitor arrivals to Macau which were 898,998 for the quarter, down 51% year-on-year and down 43% quarter-on-quarter. Visitor arrivals from the Mainland were 800,127, down 52% year-on-year and down 43% quarter-on-quarter. Overnight visitors were 460,481, down 46% year-on-year and down 24% quarter-on-quarter.

Group Financial Results

In Q3 2022, the Group posted Net Revenue of $2.0 billion, down 52% year-on-year and down 16% quarter-on-quarter. Adjusted EBITDA was $(581) million Vs $503 million in Q3 2021 and $(384) million in Q2 2022. Galaxy Macau™’s Adjusted EBITDA was $(299) million Vs $454 million in Q3 2021 and $(188) million in Q2 2022. StarWorld Macau’s Adjusted EBITDA was $(169) million Vs $25 million in Q3 2021 and $(158) million in Q2 2022. Broadway Macau™’s Adjusted EBITDA was $(16) million Vs $(19) million in Q3 2021 and $(19) million in Q2 2022. Latest twelve months Adjusted EBITDA was $653 million, down 81% year-on-year and down 62% quarter-on-quarter.

During Q3 2022, GEG played unlucky in its gaming operations which decreased Adjusted EBITDA by approximately $20 million. Normalized Q3 2022 Adjusted EBITDA was $(561) million, Vs $483 million in Q3 2021 and $(408) million in Q2 2022.

Summary Table of GEG Q3 2022 Adjusted EBITDA and Adjustments:

|

in HK$’m |

Q3 2021 |

Q2 2022 |

Q3 2022 |

|

Adjusted EBITDA |

503 |

(384) |

(581) |

|

Luck1 |

20 |

24 |

(20) |

|

Normalized Adjusted EBITDA |

483 |

(408) |

(561) |

The Group’s total GGR on a management basis2 in Q3 2022 was $0.9 billion, down 75% year-on-year and down 34% quarter-on-quarter. Mass GGR was $0.8 billion, down 65% year-on-year and down 32% quarter-on-quarter. VIP GGR was $56 million, down 95% year-on-year and down 63% quarter-on-quarter. Electronic GGR was $64 million, down 57% year-on-year and down 15% quarter-on-quarter.

|

Group Key Financial Data |

|

|

|

|||

|

(HK$’m) |

Q3 2021 |

|

Q2 2022 |

|

Q3 2022 |

|

|

Revenues: |

|

|

|

|

|

|

|

Net Gaming |

2,913 |

|

1,228 |

|

821 |

|

|

Non-gaming |

608 |

|

456 |

|

438 |

|

|

Construction Materials |

761 |

|

740 |

|

775 |

|

|

Total Net Revenue |

4,282 |

|

2,424 |

|

2,034 |

|

|

Adjusted EBITDA |

503 |

|

(384) |

|

(581) |

|

|

|

|

|

|

|

|

|

|

Gaming Statistics3 |

|

|

|

|

|

|

|

(HK$’m) |

|

|

|

|

|

|

|

Q3 2021 |

|

Q2 2022 |

|

Q3 2022 |

||

|

Rolling Chip Volume |

33,4214 |

|

3,6465 |

|

2,7825 |

|

|

Win Rate % |

3.7% |

|

4.2% |

|

2.0% |

|

|

Win |

1,234 |

|

153 |

|

56 |

|

|

|

|

|

|

|

||

|

Mass Table Drop6 |

10,099 |

|

4,610 |

|

3,301 |

|

|

Win Rate % |

22.8% |

|

25.3% |

|

24.2% |

|

|

Win |

2,301 |

|

1,165 |

|

798 |

|

|

|

|

|

|

|

||

|

Electronic Gaming Volume |

4,187 |

|

2,639 |

|

1,696 |

|

|

Win Rate % |

3.6% |

|

2.9% |

|

3.8% |

|

|

Win |

150 |

|

76 |

|

64 |

|

|

|

|

|

|

|

|

|

|

Total GGR Win7 |

3,6858 |

|

1,3949 |

|

9189 |

Balance Sheet

The Group’s balance sheet remains liquid and healthy. As of 30 September 2022, cash and liquid investments were $22.5 billion and net cash was $19.3 billion. Debt was $3.2 billion which primarily reflects our ongoing treasury yield management initiatives where interest income on cash holdings exceeds corresponding borrowing costs. Core debt remained minimal at $0.3 billion.

Galaxy Macau™

Galaxy Macau™ is the primary contributor to the Group’s revenue and earnings. Net Revenue in Q3 2022 was $1.1 billion, down 62% year-on-year and down 25% quarter-on-quarter. Adjusted EBITDA was $(299) million Vs $454 million in Q3 2021 and $(188) million in Q2 2022.

Galaxy Macau™ played unlucky in its gaming operations which decreased its Adjusted EBITDA by approximately $20 million in Q3 2022. Normalized Q3 2022 Adjusted EBITDA was $(279) million, Vs $442 million in Q3 2021 and $(212) million in Q2 2022.

Hotel occupancy of available rooms for Q3 2022 across the five hotels was 26%.

|

Galaxy Macau™ Key Financial Data |

||||||

|

(HK$’m) |

|

|

|

|||

|

Q3 2021 |

|

Q2 2022 |

|

Q3 2022 |

||

|

Revenues: |

|

|

|

|

|

|

|

Net Gaming |

2,279 |

|

1,016 |

|

663 |

|

|

Hotel / F&B / Others |

288 |

|

175 |

|

171 |

|

|

Mall |

269 |

|

244 |

|

238 |

|

|

Total Net Revenue |

2,836 |

|

1,435 |

|

1,072 |

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

454 |

|

(188) |

|

(299) |

|

|

Adjusted EBITDA Margin |

16% |

|

NEG10 |

|

NEG10 |

|

|

|

|

|

|

|

|

|

|

Gaming Statistics11 |

|

|

|

|

|

|

|

(HK$’m) |

|

|

|

|

|

|

|

Q3 2021 |

|

Q2 2022 |

|

Q3 2022 |

||

|

Rolling Chip Volume |

24,49612 |

|

3,64613 |

|

2,78213 |

|

|

Win Rate % |

3.7% |

|

4.2% |

|

2.0% |

|

|

Win |

907 |

|

153 |

|

56 |

|

|

|

|

|

|

|

||

|

Mass Table Drop14 |

6,592 |

|

3,317 |

|

2,422 |

|

|

Win Rate % |

26.4% |

|

27.6% |

|

26.4% |

|

|

Win |

1,743 |

|

915 |

|

641 |

|

|

|

|

|

|

|

||

|

Electronic Gaming Volume |

2,947 |

|

1,589 |

|

1,021 |

|

|

Win Rate % |

4.1% |

|

3.4% |

|

5.1% |

|

|

Win |

122 |

|

54 |

|

52 |

|

|

|

|

|

|

|

|

|

|

Total GGR Win |

2,772 |

|

1,122 |

|

749 |

|

StarWorld Macau

StarWorld Macau’s Net Revenue in Q3 2022 was $158 million, down 76% year-on-year and down 28% quarter-on-quarter. Adjusted EBITDA was $(169) million Vs $25 million in Q3 2021 and $(158) million in Q2 2022.

There was no luck impact on StarWorld Macau’s Adjusted EBITDA in Q3 2022.

Hotel occupancy of available rooms for Q3 2022 was 24%.

|

StarWorld Macau Key Financial Data |

||||||

|

(HK$’m) |

|

|

|

|||

|

Q3 2021 |

|

Q2 2022 |

|

Q3 2022 |

||

|

Revenues: |

|

|

|

|

|

|

|

Net Gaming |

627 |

|

198 |

|

139 |

|

|

Hotel / F&B / Others |

30 |

|

17 |

|

17 |

|

|

Mall |

7 |

|

5 |

|

2 |

|

|

Total Net Revenue |

664 |

|

220 |

|

158 |

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

25 |

|

(158) |

|

(169) |

|

|

Adjusted EBITDA Margin |

4% |

|

NEG15 |

|

NEG15 |

|

|

|

|

|

|

|

|

|

|

Gaming Statistics16 |

|

|

|

|

|

|

|

(HK$’m) |

|

|

|

|

|

|

|

Q3 2021 |

|

Q2 2022 |

|

Q3 2022 |

||

|

Rolling Chip Volume17 |

8,925 |

|

0 |

|

0 |

|

|

Win Rate % |

3.7% |

|

0 |

|

0 |

|

|

Win |

327 |

|

0 |

|

0 |

|

|

|

|

|

|

|

||

|

Mass Table Drop18 |

2,825 |

|

982 |

|

795 |

|

|

Win Rate % |

16.0% |

|

20.6% |

|

18.2% |

|

|

Win |

453 |

|

202 |

|

144 |

|

|

|

|

|

|

|

||

|

Electronic Gaming Volume |

585 |

|

342 |

|

228 |

|

|

Win Rate % |

2.4% |

|

2.4% |

|

2.6% |

|

|

Win |

14 |

|

9 |

|

6 |

|

|

|

|

|

|

|

|

|

|

Total GGR Win |

794 |

|

211 |

|

150 |

|

Broadway Macau™

Broadway Macau™ is a unique family friendly, street entertainment and food resort supported by Macau SMEs. The property’s Net Revenue in Q3 2022 was $10 million, Vs $14 million in Q3 2021 and $15 million in Q2 2022. Adjusted EBITDA was $(16) million Vs $(19) million in Q3 2021 and $(19) million in Q2 2022. There was no luck impact on Broadway Macau™’s Adjusted EBITDA in Q3 2022. Hotel occupancy of available rooms for Q3 2022 was 20%.

City Clubs

In Q3 2022, City Clubs Adjusted EBITDA was $(26) million, Vs $7 million in Q3 2021 and $11 million in Q2 2022. Effective in June 2022, we ceased operations at Rio Casino and President Casino with the aim to optimize the Company’s operational scale.

Construction Materials Division

The Construction Materials Division contributed Adjusted EBITDA of $117 million in Q3 2022, down 51% year-on-year and down 31% quarter-on-quarter this was due to higher coal prices and lockdowns in China that impacted demand.

Development Update

Galaxy Macau™ and StarWorld Macau

We continue to make ongoing progressive enhancements to our resorts to ensure that they remain competitive and appealing to our guests.

Cotai – The Next Chapter

GEG is uniquely positioned for long term growth. Phase 3 is effectively completed and we look forward to welcoming the iconic Raffles at Galaxy Macau through an exclusive 450 all-suite tower. We will align the opening with prevailing market conditions. We intend to follow this with the opening of the GICC and Andaz Macau in anticipation of the recovery of the MICE and entertainment markets.

We are now firmly focused on the development of Phase 4, which is already well under way. We see the premium market evolving with this segment preferring higher quality and more spacious rooms. We continue to proceed with the construction of Cotai Phase 4, our next generation integrated resort, which will complete our ecosystem in Cotai.

Phases 3 & 4 combined will have approximately 3,000 high end and family rooms and villas, 400,000 square feet of MICE space, a 500,000 square feet 16,000-seat multi-purpose arena, F&B, retail and casinos, among others. As you can see, we remain highly confident about the future of Macau where Cotai Phases 3 & 4 will support Macau’s vision of becoming a World Centre of Tourism and Leisure.

Selected Major Awards in 2022

|

AWARD |

PRESENTER |

||

|

GEG |

|

||

|

Most Outstanding Company in Hong Kong – Casinos & Gaming Sector |

Asiamoney |

||

|

Top 10 Company in “The 2nd Hotel Business Sustainability Index” Top 20 Company in “The 7th Hong Kong Business Sustainability Index” Top 20 Company in “The 3rd Greater Bay Area Business Sustainability Index” |

Centre for Business Sustainability, CUHK Business School |

||

|

Charitable Community Award |

International Gaming Awards 2022 |

||

|

GALAXY MACAU™ |

|||

|

EarthCheck Certified 2022 – Gold Certification – Banyan Tree Macau – Silver Certification – Galaxy Hotel™ – Silver Certification – Hotel Okura Macau |

EarthCheck |

||

|

Macao’s Best Resorts Spa 2022 – Banyan Tree Spa |

World Spa Awards |

||

|

Green Key – Hotel Okura Macau & Galaxy Hotel™ |

The Foundation for Environmental Education |

||

|

Macao Green Hotel Award 2021 – Gold Award – Hotel Okura Macau |

Environmental Protection Bureau (DSPA) |

||

|

Michelin Guide Hotel Selection – Banyan Tree Macau – JW Marriott Hotel Macau – The Ritz-Carlton, Macau |

Michelin One Star Restaurant – 8½ Otto e Mezzo BOMBANA – Lai Heen

|

Michelin Selected Restaurant – Terrazza Italian Restaurant – Yamazato – The Ritz-Carlton Café |

Michelin Guide Hong Kong and Macau 2022 |

|

Forbes Travel Guide Five-star Hotel – The Ritz-Carlton, Macau – Banyan Tree Macau – Hotel Okura Macau |

Forbes Travel Guide Five-star Restaurant – Lai Heen

|

Forbes Travel Guide Five-star Spa – The Ritz-Carlton Spa, Macau – Banyan Tree Spa Macau |

Forbes Travel Guide |

|

LEED V4 Gold Certificate – Galaxy Macau Phase 3 (MICE) |

U.S. Green Building Council |

||

|

Best Hotel for Business Travelers 2022 |

CNBC |

||

|

STARWORLD MACAU |

|||

|

Michelin Two Stars Restaurant – Feng Wei Ju |

Michelin Guide Hong Kong and Macau 2022 |

||

|

South China Morning Post 100 Top Tables 2022 – Feng Wei Ju |

South China Morning Post |

||

|

BROADWAY MACAU™ |

|||

|

Macao Green Hotel Award 2021 – Silver Award – Broadway Hotel |

Environmental Protection Bureau (DSPA) |

||

|

CONSTRUCTION MATERIALS DIVISION |

|||

|

BOCHK Corporate Environmental Leadership Awards 2021 – EcoPartner – 5 Years Plus EcoPioneer |

Bank of China (Hong Kong) and Federation of Hong Kong Industries |

||

|

Hong Kong Green Organization – Hong Kong Green Organization Recognition |

Environmental Campaign Committee |

||

|

Caring Company Logo 2021/22 – 20 Years Plus Caring Company Logo |

The Hong Kong Council of Social Service |

||

Outlook

As stated previously we have submitted our Macau gaming concession tender. We are well positioned to support the long term development of Macau and its vision of becoming a World Centre for Tourism and Leisure.

We are pleased to see that Macau’s boarders have been reopened to foreigners from 41 countries, where visitors still need to undergo hotel quarantine. Further, on 1 November 2022, E-visas were resumed and package tours to Macau are expected to resume shortly. We are encouraged by these decisions and view them as positive steps in the right direction to gradually resume normal economic activities and daily life. We do acknowledge that further flare ups of COVID-19 may result in sporadic travel restrictions which would impact visitation to Macau, associated revenue and effect our future financial performance.

The Macau concessionaires continue to work with the MGTO to actively promote Macau as a safe and high-quality destination and we have participated in a series of roadshows across the Greater Bay Area. Moreover, we continue to actively support a wide range of sports, arts, cultural events and tourism activities to promote Macau’s unique festive culture.

Our balance sheet continues to remain healthy and liquid with net cash of $19.3 billion, our conservative financial management provides the Group with valuable flexibility in managing our ongoing operations and allows us to continue with our longer term development plans. These plans include the completion of Phase 3 and the continuing development of Phase 4. We continue our commitment to support the Macau government in its economic recovery and maintain the social stability of Macau. Notwithstanding the current economic environment, we continue with our disciplined approach to exploring opportunities within Mainland China with a particular focus on the Greater Bay Area.

We remain cautious on the outlook for the remainder of 2022. In the medium to longer term we still have great confidence in the future of Macau and believe that there remains significant demand for leisure, tourism and travel throughout Asia. Finally, we would like to thank all of our staff whom have worked hard to deliver GEG’s renowned “World Class, Asian Heart” service and support the company through these challenging times.

About Galaxy Entertainment Group (HKEx stock code: 27)

Galaxy Entertainment Group (“GEG” or the “Group”) is one of the world’s leading resorts, hospitality and gaming companies. It primarily develops and operates a large portfolio of integrated resort, retail, dining, hotel and gaming facilities in Macau. The Group is listed on the Hong Kong Stock Exchange and is a constituent stock of the Hang Seng Index.

GEG is one of the three original concessionaires in Macau with a successful track record of delivering innovative, spectacular and award-winning properties, products and services, underpinned by a “World Class, Asian Heart” service philosophy, that has enabled it to consistently outperform the market in Macau.

GEG operates three flagship destinations in Macau: on Cotai, Galaxy Macau™, one of the world’s largest integrated destination resorts, and the adjoining Broadway Macau™, a unique landmark entertainment and food street destination; and on the Peninsula, StarWorld Macau, an award winning premium property.

The Group has the largest undeveloped landbank of any concessionaire in Macau. When The Next Chapter of its Cotai development is completed, GEG’s resorts footprint on Cotai will double to more than 2 million square meters, making the resorts, entertainment and MICE precinct one of the largest and most diverse integrated destinations in the world. These projects will help GEG develop and support Macau in its vision of becoming a World Centre of Tourism and Leisure.

In July 2015, GEG made a strategic investment in Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco (“Monte-Carlo SBM”), a world renowned owner and operator of iconic luxury hotels and resorts in the Principality of Monaco. GEG continues to explore a range of international development opportunities with Monte-Carlo SBM.

GEG is committed to delivering world class unique experiences to its guests and building a sustainable future for the communities in which it operates. For more information about the Group, please visit www.galaxyentertainment.com

____________________________

1 Reflects luck associated with our rolling chip program.

2 The primary difference between statutory gross revenue and management basis gross revenue is the treatment of City Clubs revenue where fee income is reported on a statutory basis and gross gaming revenue is reported on a management basis. At the Group level the gaming statistics include Company owned resorts plus City Clubs.

3 Gaming statistics are presented before deducting commission and incentives.

4 Represents sum of junket VIP and inhouse premium direct.

5 Represents inhouse premium direct.

6 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

7 Total GGR win includes gaming win from City Clubs.

8 Q3 2021 GGR included 3 City Clubs.

9 Q2 2022 GGR included 3 City Clubs only up to 26 June 2022 and Q3 2022 GGR only includes Waldo Casino.

10 NEG represents negative margin.

11 Gaming statistics are presented before deducting commission and incentives.

12 Represents sum of junket VIP and inhouse premium direct.

13 Represents inhouse premium direct.

14 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

15 NEG represents negative margin.

16 Gaming statistics are presented before deducting commission and incentives.

17 Reflects junket VIP.

18 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

Contacts

For Media Enquiries:

Galaxy Entertainment Group – Investor Relations

Mr. Peter J. Caveny / Ms. Yoko Ku / Ms. Joyce Fung

+852 3150 1111

ir@galaxyentertainment.com

.jpg)