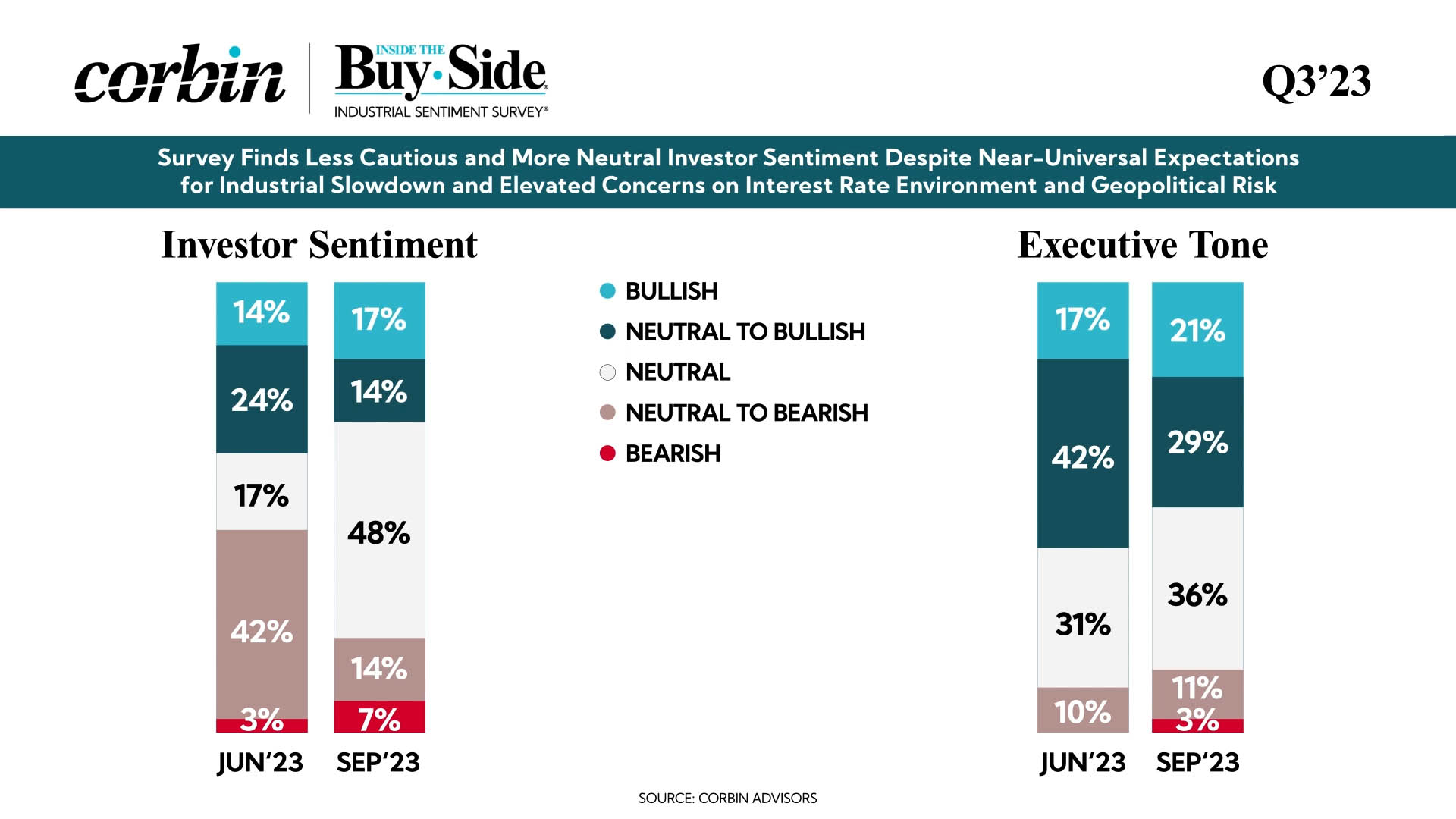

Survey Finds Less Cautious and More Neutral Investor Sentiment Despite Near-Universal Expectations for Industrial Slowdown and Elevated Concerns on Interest Rate Environment and Geopolitical Risk

- 48% of investors characterize their sentiment as Neutral, up from just 17% last quarter, with most notably rotating out of the Neutral to Bearish camp, now 14% from 45% QoQ

- 50% describe executive tone as Neutral to Bullish or Bullish, down from 59% last quarter

- 64% expect Industrial earnings to Meet consensus, with more optimism around EPS and FCF performances QoQ; views on Operating Margins are decidedly mixed

- Debt Paydown reclaims the top spot as a preferred use of cash, overtaking Reinvestment

- While 96% expect broad-based Industrial Weakness in 2023 and beyond, predictions for 2023 Industrial Organic Growth improve 150 bps to 5.3% QoQ

- Geopolitical Risk as a leading concern sees the largest QoQ increase with 93% explicitly citing China as the main driver

- Growing geopolitical concerns lead to increased Bullishness in Defense and Commercial Aero, while Ag and Auto see biggest increases in negative sentiment

Click Here to Access the Full Report

HARTFORD, Conn.–(BUSINESS WIRE)–Corbin Advisors, a strategic consultancy accelerating value realization globally, today released its quarterly Industrial Sentiment Survey®. The survey, part of Corbin Advisors’ Inside The Buy-Side® flagship research publication, was conducted from September 5 to October 11, 2023, and is based on responses from 56 institutional investors and sell-side analysts globally, who actively cover the Industrial sector. The buy-side firms represented in our survey manage more than $6.4 trillion in assets and have $535 billion invested in Industrials.

Following last quarter’s survey that identified increasingly more cautious investor sentiment and more pronounced management optimism heading into Q2 earnings season, the Voice of Investor® captured in this quarter’s survey finds Neutral to Bearish views meaningfully shifting to Neutral while perceived executive tone continues to largely be described as Neutral to Bullish to Bullish, but with some notable easing. For Q3’23 earnings prints, 64% expect results to be In Line with consensus. Regarding KPIs, expectations are for Improving EPS and FCF, while Revenue Growth is anticipated to be Staying the Same. Coming out of Q2’23 earnings season, S&P 500 Industrial constituents logged 16% and 4% EPS and Sales growth on average. Views on Margins are decidedly split, though 37% expect Worsening results, up from 24% last quarter. More than 50% of surveyed financial professionals anticipate 2023 outlooks to be Maintained across all metrics.

“Following Q2, where results largely surprised to the upside and many companies raised 2023 guides, sentiment this survey captures softening pessimism in the near term, but growing concern in the longer term, as evidenced by a more upbeat 2023 Industrial Organic Growth expectation of 5.3%, an increase of 150 basis points QoQ, and 96% already seeing or anticipating that industrial growth is slowing and will continue to do so into 2024,” said Rebecca Corbin, Founder and CEO of Corbin Advisors. “Demand is the leading identified concern for the second consecutive quarter as caution over destocking grows, followed by interest rates, as ‘higher for longer’ will put added upward pressure on the cost of capital and temper the appetite for capex spend. Amid this backdrop and with the run-up that Industrials have seen this year, valuations are described as ‘extremely rich’ in general. Leading topics for executives to address on upcoming earnings calls include updates on inflation and pricing power, demand, and related inventory and destocking trends, and margins, which 68% of surveyed investment professionals report prioritizing over growth at this time.”

Looking ahead, 9 in 10 investors are bracing for broad-based industrial weakness. While 58% are already seeing or expect to see weakness in 2023, predictions are increasingly moving beyond year end, as 38% now anticipate timing coinciding with 2024, up from 21% last quarter. To that end, demand, interest rates, and a slowing economy are among the leading concerns identified this quarter, and Global PMI and Consumer Confidence are seen as the most challenged indicators looking ahead, with 50% and 59% expecting Worsening conditions over the next six months, respectively.

“Longer term, I am bullish toward the industrial sector. The years of underinvestment and seeing capital return to shores will be positive for any U.S. listed name or those with U.S. exposure. In the short term, I am more neutral to bearish. The cyclical stocks and valuations have run up considerably, and indications are the economy is growing slower to decelerating,” commented one Portfolio Manager whose firm manages ~$7.0B in Industrial equity assets.

Reflecting concerns about the future state, investors are increasingly inclined toward prioritizing debt paydown at this time, cited as the leading preferred use of cash, while views toward reinvestment — still the second most preferred use — ebb QoQ. Notably, 54% support Maintaining current levels, up from 58%, while just 3% support Increasing growth capex at this time, receding from >20% in the past two quarters, and off the high of 45% in Q4’22.

Views on global economies continues to see North America as the most compelling over the next six months, while APAC (ex-China) gains ground as an economy expected to Improve. However, risk aversion to China continues to grow as 73% now assign a High or Very High level of risk to companies with exposure, up from 65% last quarter.

Regarding sub-sector sentiment, Defense and Commercial Aero continue to capture the most upbeat views as 49% cite geopolitical risks as a concern this quarter, more than doubling from just 21% last quarter, while Non-Residential Construction shakes off bears and sees the largest increases in positive support. Residential Construction garners the most outright negative sentiment, while bears topple into Agriculture and Automotive, each garnering their highest level of negative views in six quarters.

About Corbin Advisors

Corbin is a strategic consultancy accelerating value realization globally. We engage deeply with our clients to assess, architect, activate, and accelerate value realization, delivering research-based insights and execution excellence through a cultivated and caring team of experts with deep sector and situational experience, a best practice approach, and an outperformance mindset.

Inside The Buy-Side®, our industry-leading research publication, is covered by news affiliates globally and regularly featured on CNBC.

To learn more about us and our impact, visit CorbinAdvisors.com

Contacts

Media

Devin Davis, Head of Marketing & Communications

(609) 577-9006

devin.davis@corbinadvisors.com