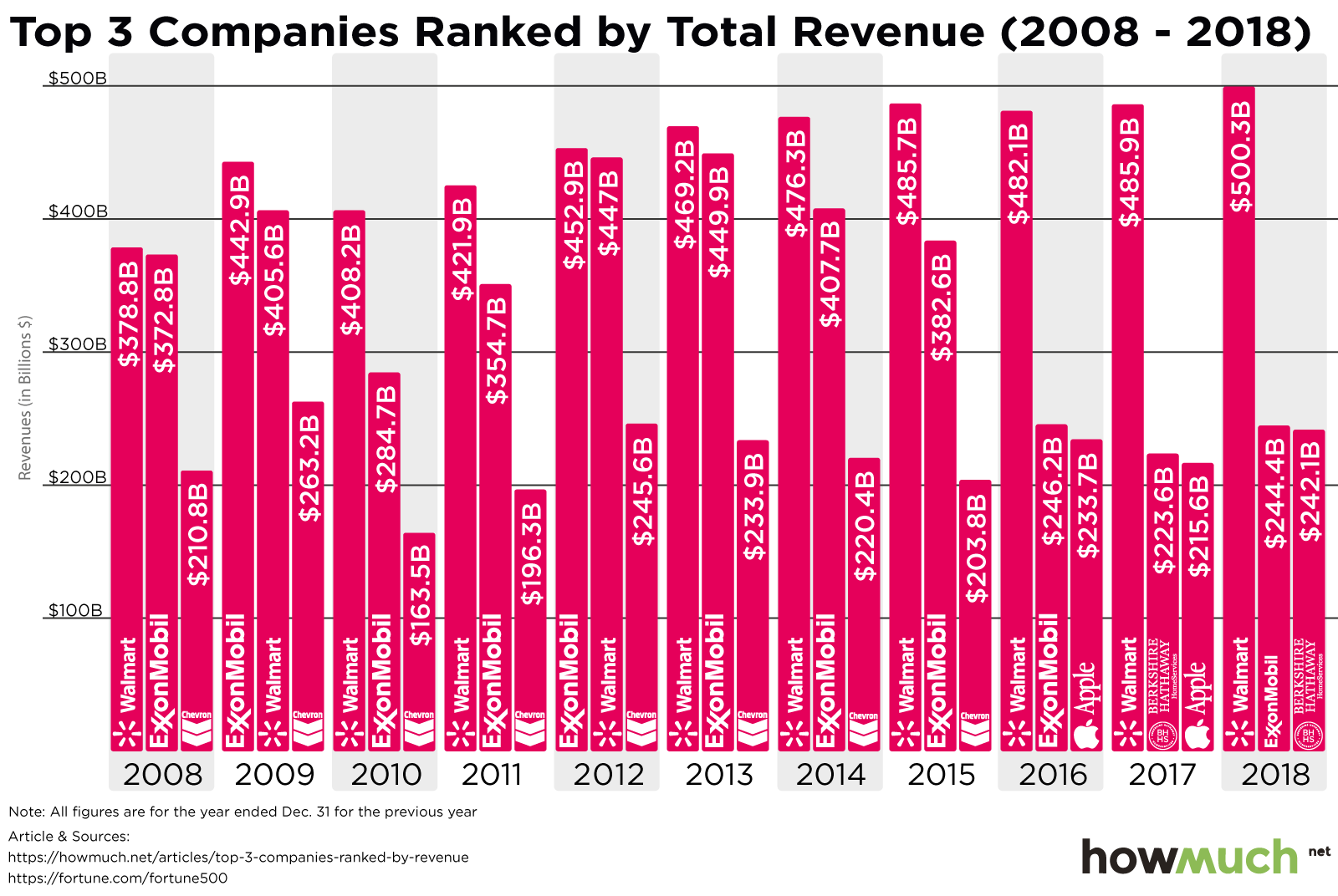

Disruption is the new buzzword in business as both big and small companies are worried about scrappy startups with better technology entering their marketplaces. Our new visualization highlights the top three U.S. companies, measured in terms of overall revenue, in the last decade. Disruption occurs at the highest levels of corporate America, but our visualization highlights just how much money is at stake.

We gathered our numbers from the annual Fortune 500 list, which Fortune refreshes every year. Numbers for each year reflect the previous year ending December 31. Before diving into an analysis of our visualization, let’s call out two underlying assumptions. First, we have not adjusted these figures for inflation. As years go by, inflation causes the value of a dollar to slowly weaken. We took this approach to preserve the rankings at the time each company posted its revenue figures, not in comparison to revenues today. Second, revenue gives you a great idea about the size of a business, but very little about profitability. A company can post record-breaking revenue numbers and still lose money, like what’s happening at Tesla right now.

All that being said, our graph raises several key insights both about the particular situations of these companies and the broader U.S. economy. Walmart has remained in the top spot nearly every single year over the past decade except two years. Today, Walmart’s revenue is more than twice as high as second-place Exxon Mobil, a gap that has consistently grown year after year. It would appear that nobody will be able to challenge the country’s largest employer for quite some time.

Another interesting trend is how oil companies like Chevron and Exxon Mobil continue to post outstanding revenue numbers, even as the price of oil has fluctuated. Our visualization suggests that these companies have developed business models that are mostly immune to market pressures. They can make tons of money and pay their investors consistent dividends, no matter what the economy is doing. They fell off the top three in 2016, but don’t count Exxon out in the years ahead.

Our visualization also reveals a shift in corporate America, namely Apple’s ascendance as one of the most valuable companies ever. Beginning in 2016 especially, the multinational tech company from Cupertino, CA started shattering revenue forecasts thanks in large part to the continued success of the iPhone. People are willing to shell out over a thousand dollars for a new phone, making Apple a luxury brand that delivers both a status symbol and a sleek user experience.

Berkshire Hathaway also made it into the top three companies, but through a very different route. Instead of continuously surpassing expectations in product development, CEO Warren Buffett simply invested in companies with solid business models, like Pilot Flying J (gas stations), Duracell (batteries), Heinz (condiments), and Prudential (insurance). Buffett also has his eyes set on disrupting the healthcare industry, which would only further increase these figures.

Nothing is permanent but change, especially in the business world where so much money is at stake. These companies generate hundreds of billions in revenue year after year, but the top three rankings now include companies that weren’t anywhere near the top in 2008. Walmart is clearly paying attention to these trends as executives explore new business models, including in ag science, drones, and logistics. Time will tell if these efforts pay off for the retail behemoth.