Small and Medium Enterprises (SMEs) can substantially contribute to a country’s long-term export growth and diversification. And trade promotion organizations can play an important role in the process. We have found this after analyzing the export performance of developing countries by using transaction-level data of all Peruvian exports between 1994 and 2019, a quarter of a century.

Think of short films and movies. Export superstars are the leading actors in developing countries’ export “short films.” They account for a significant fraction of their total foreign sales in the short to medium run. According to existing studies, the five largest firms were found to be responsible for about one-third of aggregate exports, almost half of export growth, and a third of growth due to diversification over five years periods.1

And then there are “full movies” and the supporting roles. In developing countries, less is known about the contribution of different kinds of firms in export “full movies.” Thus, the movie’s plot —and this blog— involves finding out the origin and dynamics of long-run export growth, to what extent initially small firms contribute to this growth, and whether and how trade policy helps them become superstars.2

Short Films: Superstar Firms Stand Out in Short to Medium Run Exports

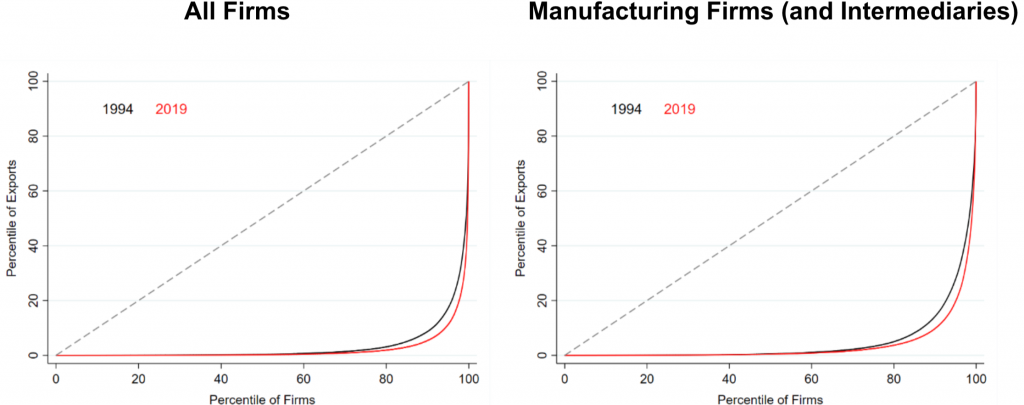

In Peru, the top five firms accounted for an average of 31% of total exports and contributed 30% to the average five-year 1994-2019 export growth. The importance of these large firms —and their coexistence with many small peers— can be easily visualized when comparing the cumulative share of exporting firms with the cumulative share of exports these firms account for. In this case, 80% of the smaller firms generate less than 10% of Peru’s total exports, both in 1994 and 2019, and regardless of whether all firms or only manufacturing (and intermediaries — retailers and wholesalers—) are considered (see Figure 1).

Figure 1

Peru, Distribution of Exports and Exporting Firms, 1994 and 2019

Rewinding: Older Export Short Films

To uncover individual stories behind large firms, instead of just focusing on the very narrow and distinct group consisting of the top 5 largest firms, we considered the top 5% exporters (i.e., roughly 300 firms). This set of firms accounted for an average of 87% of Peru’s total exports over the period 1994-2019 and, as such, provides a broader picture of the diverse dynamics behind high performers in international markets.

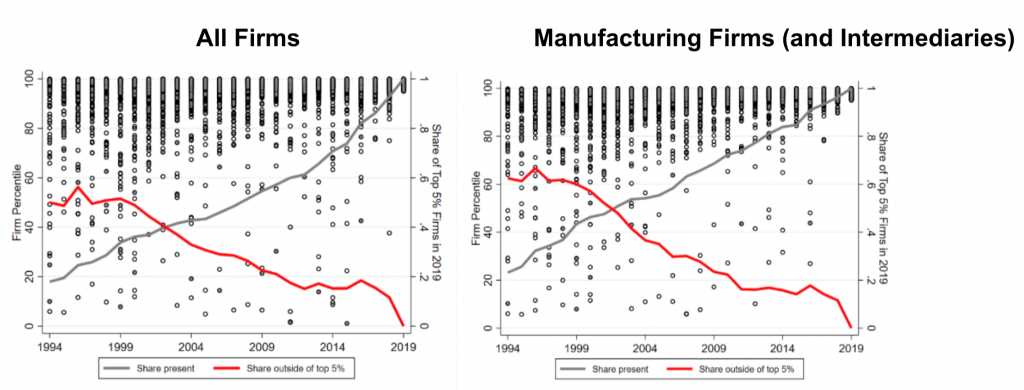

Where were the top 5% exporting firms in the previous 25 annual rankings? When we trace backward these firms, different stories emerge. In 1994, only 20% of them were already exporting and spanned the entire firm size distribution. Out of those, almost half were outside of the top 5% (60% in the case of manufacturers and intermediaries). The same applies to both domestic firm and multinational firms —with the latter being 15% of the top 5% exporters in 2019— (see Figure 2). Significantly, 43% of these top exporting firms were Small and Medium-sized Enterprises (SMEs) both in the same year and over the period 2000-2010.3

Figure 2

Peru, Top 5% Exporting Firms in 2019, 1994-2019

Note: Each marker corresponds to a top 5% firm in 2019. Gray-filled markers identify multinational firms.

The Full Movie: SMEs Play an Important Role in the Long Run Export Growth and Diversification

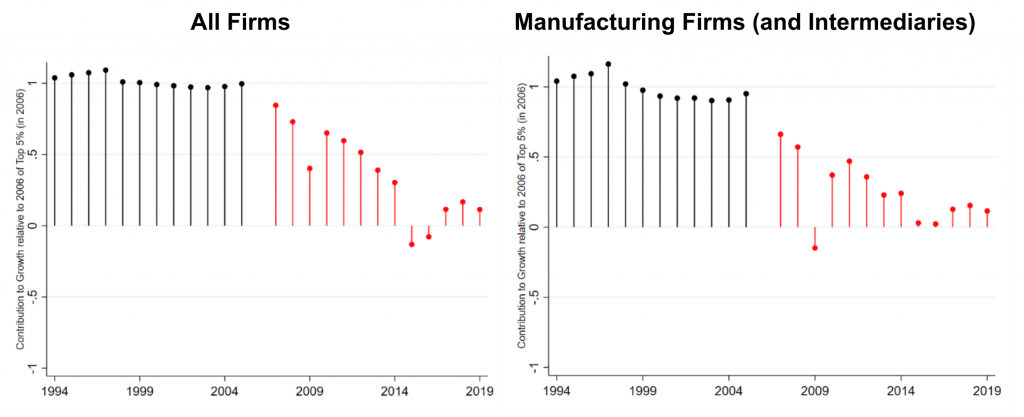

How much different kinds of firms contribute to aggregate export growth depends on the perspective: backward or forward. The existing literature has typically followed the former. In this case, we found that Peru’s top 5% exporters in 2019 contributed around 90% to the export growth between 1994-2019.

However, this amounts to start watching the movie from its happy end and recreate the story backward based thereon: the sample of top firms is a selection of firms that did exceptionally well. As such, they are likely to have contributed substantially to the overall export growth. This can clearly be seen when an intermediate year such as 2006 is used as a reference. The backward contribution of top firms in 2006 to export growth is almost 100%, whereas their forward contribution steadily declines to about 20% in 2006-2019 growth (see Figure 3).

Figure 3

Peru, Backward and Forward Contribution to Aggregate Export Growth of Top 5% Firms, 1994-2019

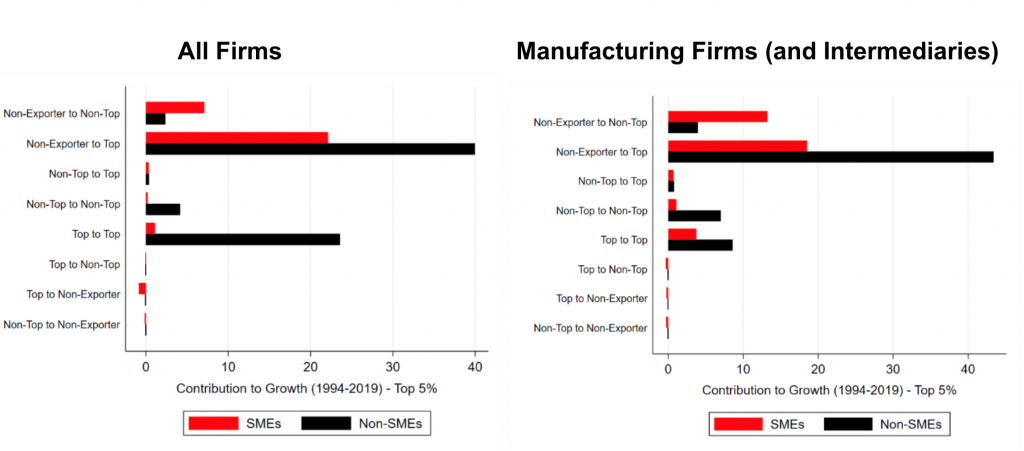

Here, we propose the reverse approach: to watch the movie as it should be — from the beginning. To do so, we computed the share of the future export growth explained by the different types of firms. More precisely, the 1994-2019 export growth is decomposed by initial exporter size and SME classification. When so doing, non-exporters that became the top 5% exporters in 2019 account for most of the export growth. Noteworthy, a significant portion of these firms were SMEs. Overall, SMEs contributed about 30% to growth over the last quarter-century (see Figure 4).

Figure 4

Peru, Contribution to Forward Export Growth, by Firm Size, 1994-2019

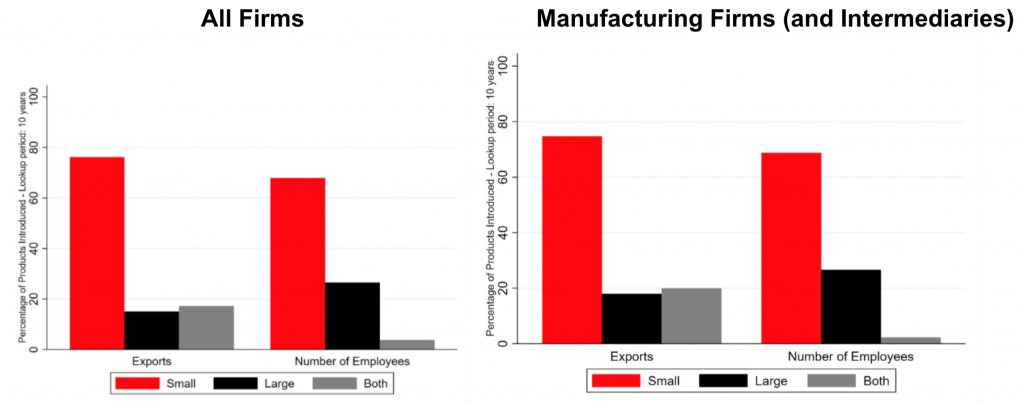

But that is not all. Smaller exporters, particularly SMEs, introduce a higher number of new products to the country’s export basket than their large counterparts, thereby making a decisive contribution to aggregate diversification.4 Thus, SMEs were responsible for approximately 70% of all new products sold abroad by Peru during the period 2005-2019 (see Figure 5).5

Figure 5

Peru, Export Product Diversification, by Firm Size, 1994-2019

Having an Agent Makes a Difference: Trade Promotion Organizations Can Help

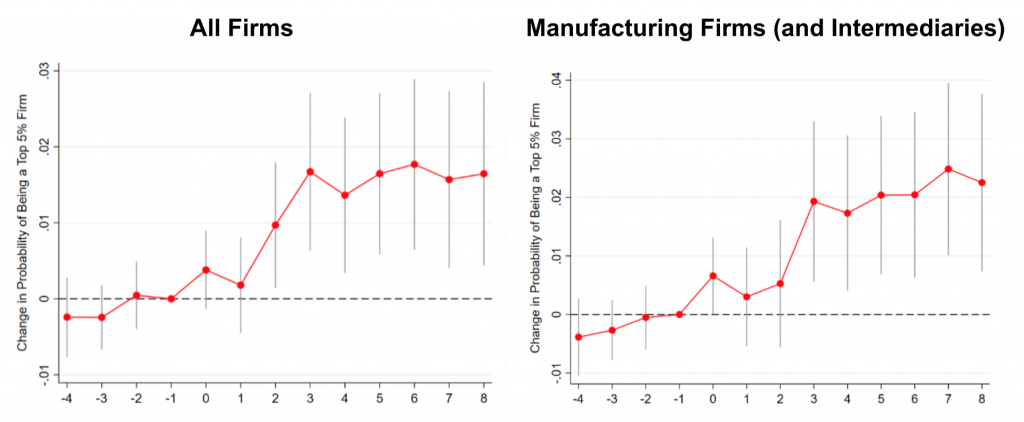

Despite the progress of information and communication technologies, firms venturing abroad for the first time, in general, and those that attempt to expand overseas, in particular, must confront severe information barriers. Trade Promotion Organizations (TPOs) provide firms with a series of services that aim at addressing these information problems. The existing empirical evidence suggests that these services effectively help firms enter and diversify in foreign markets. The Peruvian experience additionally reveals that trade promotion could also effectively support firms in rising the export ladder: firms assisted by the national TPOs were significantly more likely to become top 5% exporters after being assisted than their non-assisted counterparts (see Figure 6).

Figure 6

Peru, Trade Promotion and Top Exporter, 2001-2019

IDB Supports Countries and their Firms in their Internationalization

This note has presented clear evidence that SMEs can make a substantial contribution to a country’s export growth and diversification and that trade promotion can help these firms play such a role in the process. Through its Integration and Trade Sector, the IDB provides countries in the region and their TPOs with technical and operational support to design and implement policies that assist firms in their internationalization. This support takes multiple forms, including loans, technical cooperation, studies, exchange fora (policy and business dialogues), and, noteworthy, a dedicated online business platform