It’s never been cheaper to own a home in 2017 than now. This despite the fact that mortgage costs surpass renting expenses across the United States. The average 30-year fixed mortgage rate in recent days reached a bottom for the year at 4.08 percent. Whether you rent or own, however, your housing costs are likely to represent 30 percent of your annual expenses.

From coast to coast, the cost of homeownership surpasses that of renting, though homeowners feel the pinch in some states more than others. The price gap between renting and owning based on dollar amounts ranges from approximately 48 percent on the high end to 30 percent on the low end, according to U.S. Census Bureau’s most recent American Community Survey data.

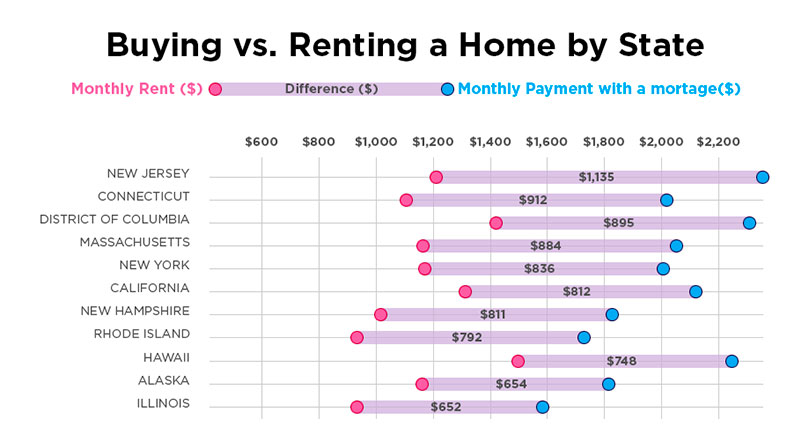

The 10 States With the Greatest Price Gap (by dollar amount) Between Homeownership and Renting

- New Jersey ($2,349 vs. $1,214)

- Connecticut ($2,020 vs. $1,108)

- Washington, D.C. ($2,312 vs. $1,417)

- Massachusetts ($2,048 vs. $1,164)

- New York ($2,009 vs. 1,173)

- California ($2,123 vs. $1,311)

- New Hampshire ($1,828 vs. $1,017)

- Rhode Island ($1,730 vs. $938)

- Hawaii ($2,248 vs. $1,500)

- Alaska ($1,817 vs. $1,163)

The Five States With the Smallest Price Gap (by dollar amount) Between Homeownership and Renting

- West Virginia ($972 vs. $675)

- Indiana ($1,089 vs. $758)

- Arkansas ($1,029 vs. 695)

- Florida ($1,394 vs. $1,046)

- South Carolina ($1,168 vs. $819)

Of the 10 states with the widest gap between renting and buying based on dollar amount, the lion’s share are located across either the Atlantic or Pacific seaboards. The Garden State holds the mantle for the greatest disparity between owning and renting. This may explain why N.J. baby boomers are increasingly choosing to rent versus own. Greenwich, Connecticut, where many Wall Street execs hang their suits, is a close second with the median home price at $1.87 million. The Mountain State boasts the smallest difference.

So if it cost more to own a home than it does to rent, why do more Americans pursue homeownership versus renting? Indeed, as of U.S. households, the lion’s share, or 63 percent, are owner-occupied, according to U.S. Census Bureau data as of October 2016. The balance of U.S. households are renter-occupied, or 37 percent.

This despite the fact that the housing bubble of 2008 left its share of casualties. Since peaking in 2004, U.S. homeownership has declined by approximately 9 percent, as of 2016 and according to Census data cited in CNBC. No generation is experiencing this more than the millennials, among whom homeownership has dropped by more than 20 percent in the same period.

Nonetheless, homeownership remains at the heart of the American dream. The benefits of homeownership can far outweigh those of renting over the long haul. Owning a piece of the American dream provides a sense of financial security that renting lacks. For instance, you can tap the equity in your home to reach other financial goals, such as retirement expenses. As a renter in any state, you can pocket some of the expenses that homeowners face, such as landscaping costs.