Geneva, -The International Air Transport Association (IATA) released demand growth results for global air freight markets for February 2017 showing an 8.4% increase in demand measured in freight tonne kilometers (FTKs) compared to the same period last year. After adjusting for the impact of the leap year in 2016, demand increased by 12% — almost four times better than the five-year average rate of 3.0%.

Freight capacity, measured in available freight tonne kilometers (AFTKs), shrank by 0.4% in February 2017.

The continued growth of air freight demand in 2017 is consistent with an uptick in world trade which corresponds with new global export orders remaining at elevated levels in March. Of particular note is the expanded volume of semi-conductor materials typically used in high-value consumer electronics.

“February further added to the cautious optimism building in air cargo markets. Demand grew by 12% in February—about four times the five-year average rate. With demand growing faster than capacity, yields got a boost. While there are signs of stronger world trade, concerns over the current protectionist rhetoric are still very real,” said Alexandre de Juniac, IATA’s Director General and CEO.

The rapid growth of niche markets such as cross-border e-commerce and time and temperature sensitive pharmaceutical are showing robust growth as noted at the World Air Cargo Symposium held in Abu Dhabi last month. “Any optimistic look at the future sees growing demand for specialized value added services. Shippers are telling us that the key to turning the current uptick in the cargo industry’s fortunes into longer-term growth is modernizing our antiquated processes. We must use the current momentum to push ahead with the elements of the e-cargo vision—including the e-air waybill which is nearing 50% market penetration,” said de Juniac.

Regional Performance

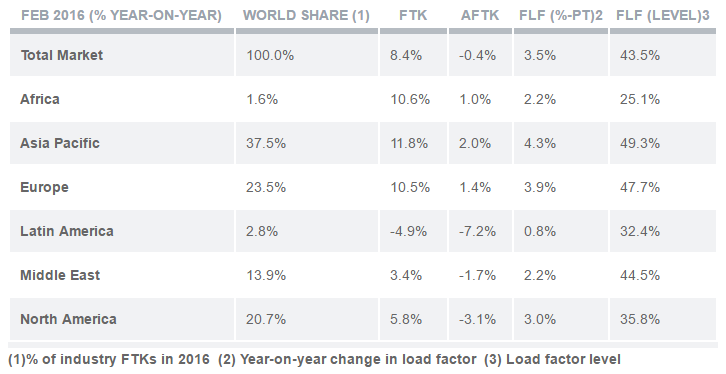

All regions, with the exception of Latin America, reported an increase in demand in February 2017.

Asia-Pacific airlines posted the largest year-on-year demand increase among regions in February 2017 with freight volumes growing 11.8% (more than 15% adjusting for the leap year). Capacity increased by 2.0% over the same time. The increase in demand is captured in the positive outlook from business surveys in the region and is reflected in the increase in trade across Asia-Pacific’s main freight lanes to, from, and within the region, which have strengthened considerably over the past six months. Seasonally-adjusted volumes dipped slightly in February but remained up considerably since early 2016 and are now back to the levels reached in 2010 during the post-global financial crisis bounce-back.

North American airlines’ freight volumes expanded 5.8% (or more than 9% adjusting for the leap year) in February 2017 compared to the same period a year earlier, and capacity decreased by 3.1%. This was driven in part by the strength of freight traffic to and from Asia which increased by 5.7% year-on-year in January. The further strengthening of the US dollar continues to boost the inbound freight market but is keeping the export market under pressure.

European airlines posted a 10.5% (or around 14% adjusting for the leap year) increase in freight volumes in February 2017 and a capacity increase of 1.4%. The ongoing weakness of the Euro continues to boost the performance of the European freight market which has benefitted from strong export orders, particularly in Germany, over the last few months.

Middle Eastern carriers’ year-on-year freight volumes increased 3.4% (or approximately 7% adjusting for the leap year) in February 2017 and capacity decreased 1.7%. Seasonally adjusted freight volumes continue to trend upwards and demand remains strong between the Middle East and Europe. Despite this, growth has eased from the double-digit rates which were the norm over the past ten years. This corresponds with a slowdown in network expansion by the region’s major carriers.

Latin American airlines experienced a contraction in demand of 4.9% (or around 1% adjusting for the leap year) in February 2017 compared to the same period in 2016 and a decrease in capacity of 7.2%. Recovery in seasonally-adjusted volumes also stalled with demand 14% lower than at the peak in 2014. And freight volumes have now been in contractionary territory in 25 out of the last 27 months. The region’s carriers have managed to adjust capacity, which has limited the negative impact on the load factor. Latin America continues to be blighted by weak economic and political conditions.

African carriers’ saw freight demand increase by 10.6% (or more than 14% adjusting for the leap year) in February 2017 compared to the same month last year and capacity increase by 1.0%. Year-to-date demand has increased by 16.2%, helped by very strong growth on the trade lanes to and from Asia. The increase in demand has helped the region’s seasonally-adjusted load factor rise by 2.8 percentage points so far in 2017.