The percentage of US dollar reserves held by central banks fell to 59% – its lowest level in 25 years – in the fourth quarter of 2020, according to the Survey on the Composition of Official Foreign Exchange Reserves (COFER ) of the IMF. Some analysts claim that this situation partly reflects the decline in the role of the US dollar in the world economy, in the face of competition from other currencies used by central banks for international transactions. If changes in central bank reserves are large enough, they can affect the currency and bond markets.

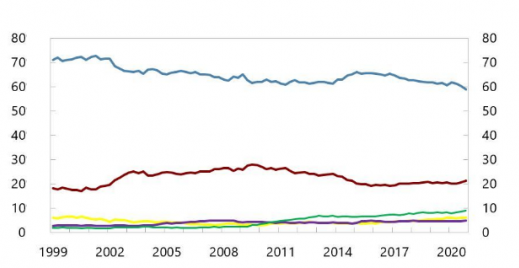

Our Chart of the Week explores the recent data release from a longer-term perspective. It shows that the percentage of US dollar assets in central bank reserves has fallen by 12 percentage points – from 71% to 59% – since the euro was introduced in 1999 (top panel), although with significant fluctuations in between (blue line). On the other hand, the share of the euro has fluctuated by approximately 20%, while the share of other currencies, including the Australian dollar, the Canadian dollar and the Chinese renminbi, increased to 9% in the fourth quarter (green line) .

Fluctuations in exchange rates can have a significant impact on the currency composition of central bank reserve portfolios. Changes in the relative values of different government securities can also have an impact, although this effect would tend to be less, since the yields of the main currency bonds tend to move together. During periods of weakness of the US dollar against major currencies, the share of the US dollar in world reserves tends to decline, as the US dollar value of the reserves denominated in other currencies rise (and vice versa in times of strong US dollar). In turn, U.S. dollar exchange rates can be influenced by a number of factors, including divergence in economic trajectories between the United States and other economies, differences in monetary and fiscal policies, as well as sales and purchases of foreign exchange by central banks.

The bottom panel shows that the value of the US dollar against the major currencies (black line) has not undergone major changes in the last two decades. However, there have been significant fluctuations in this period, which may explain about 80% of the short-term (quarterly) variance in the percentage of the US dollar in world reserves since 1999. The remaining 20% of the short-term variance can be explained mainly by the active buying and selling decisions of central banks in support of their currencies.

In this last year, once the impact of exchange rate movements is accounted for (orange line), it is observed that the percentage of the US dollar in reserves has remained stable in general terms. However, taking a longer-term perspective, the fact that the value of the US dollar has not undergone major changes, while its share in world reserves has declined, indicates that central banks have indeed been , leaving the US dollar gradually.

Some expect the share of the US dollar in world reserves to continue to decline as central banks in emerging market and developing economies attempt to diversify the composition of their foreign exchange reserves. A few countries, such as Russia, have already announced their intention to do so.

Despite major structural changes in the international monetary system over the past six decades, the US dollar remains the dominant international reserve currency. As our Chart of the Week shows, changes in the status of the US dollar would manifest in the long term.